Development Status and Future Trend of Sulfur Industry in China

2023-12-14

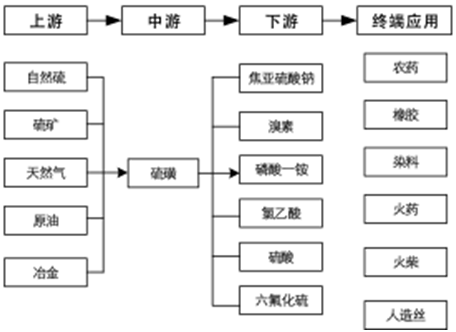

1 China's sulfur industry chain

With the increasing process of oil and gas exploration and exploitation, as well as the continuous growth of the demand for sulfur downstream industry chain in China, the industry chain products are gradually enriched.See Figure 1 for details.

Figure 1 Schematic diagram of sulfur industry chain

2 Current situation of domestic and foreign sulfur industry market

Table 1 Supply and Demand Balance of Domestic Sulfur Products

| Year |

Yield |

Imports |

export volume |

| 2013 |

557 |

1055 |

0.17 |

| 2014 |

591 |

1024 |

0.16 |

| 2015 |

574 |

1193 |

0.02 |

| 2016 |

550 |

1196 |

0.43 |

| 2017 |

594 |

1124 |

0.29 |

| 2018 |

638 |

1078 |

0.07 |

| 2019 |

705 |

1173 |

0.10 |

| 2020 |

791 |

854 |

0.27 |

| 2021 |

849 |

853 |

0.15 |

| 2022 |

935 |

765 |

2.00 |

Domestic sulfur mainly comes from crude oil processing desulfurization, natural gas purification desulfurization and coal chemical industry, while sulfur from crude oil processing and natural gas purification accounts for 94% of the total production capacity, of which the sulfur production capacity of natural gas purification plants accounts for 25% of the total domestic production capacity. The distribution of proven natural gas resources in China is mainly concentrated in the western region, especially in the northeast of Sichuan, such as the northeast Sichuan gas field and the Puguang gas field. In terms of regional division, domestic sulfur production is mainly distributed in southwest, east and south China. Among them, the southwest region is the region with the largest sulfur production capacity in China, accounting for 27.5 per cent of the country's total production and 37.4 per cent of the country's total production. The sulfur in Southwest China mainly comes from Sinopec Puguang Gas Field, Yuanba Gas Field and PetroChina Southwest Oil and Gas Field Company.

Table 2 Proportion of sulfur consumption in China in 2022

| Classification |

Proportion/% |

| phosphate fertilizer |

55.07 |

| Sulfuric acid |

19.49 |

| Caprolactam |

7.33 |

| titanium dioxide |

7.91 |

| Other |

10.20 |

3 Sulfur industry related policies and standards and regulations

4 Future Development Trend of Sulfur Industry in China

REAL-TIME NEWS

Yangzhou Jiaming Environmental Protection Technology Co., Ltd.

Address: Fangxiang Industrial Park, Hanjiang District, Yangzhou City, Jiangsu Province

Contact: Tang Jiafu13951439212

Contact: Wu Weimin13952058396

E-mail:jmkj88@yeah.net

Scan QR Code

Copyright:Yangzhou Jiaming Environmental Protection Technology Co., Ltd.